A Brief Look at the COVID-19 Saliva Testing Global Market

The recent FDA approval of an OTC test shows that COVID-19 saliva testing may be poised for bigger and better things in the years ahead.

Saliva-based COVID-19 kits first became a viable alternative test option early during the public health emergency (PHE) when the nasopharyngeal swabs used to collect tissue samples for conventional tests were in desperately short supply. To date, over 30 different saliva test kits and products have received emergency use authorization (EUA) from the FDA. But despite their advantages, saliva kits remain a marginal part of the COVID-19 diagnostic testing market, at least in the US. Even so, there are signs that saliva testing may be poised for bigger and better things in the years ahead.

Drivers of Saliva Testing Growth

Most current COVID-19 tests are performed on tissue samples collected by inserting a long nasopharyngeal swab deep into the nostril. The downside of swab collection is that it may:

- Be uncomfortable for patients and thus contribute to “testing fatigue”

- Not be suitable for young people or those with special needs

- Be susceptible to supply chain disruption

- Require trained lab personnel using PPE, either or both of which could be in short supply

Saliva-based testing eliminates these disadvantages. It’s noninvasive, suitable for all individuals, simple, can be performed at the point of care, and is largely impervious to supply chain disruptions. Saliva samples are also stable and can be preserved for at least 20 days, according to a Frontiers in Virology study.1

The Global Market for COVID-19 Saliva Tests

At the start of the pandemic in 2020, the consensus was that the global market for COVID-19 saliva screening was between $1.4 to $1.6 billion US. However, while some consulting firms project compound annual growth rates (CAGR) as high as 4.8 percent through 2030, others predict modest declines. According to a report from research and consulting firm Fact.MR and an article on the report in BioSpace, as of 2021:2,3

- By product, PCR-based kits constitute approximately 73.5 percent of the global market value share, almost three times greater than the share for point-of-care products;

- By technology, RT-qPCR has the highest global market share at 49 percent revenue;

- At 26.8 percent share, diagnostic labs are the largest end user, although academic and research institutes are expected to increase at a higher CAGR of 2.5 percent.

North America accounts for the largest share of global sales at 34 percent (with 91 percent of those sales coming from the US), followed by Europe and South Asia.

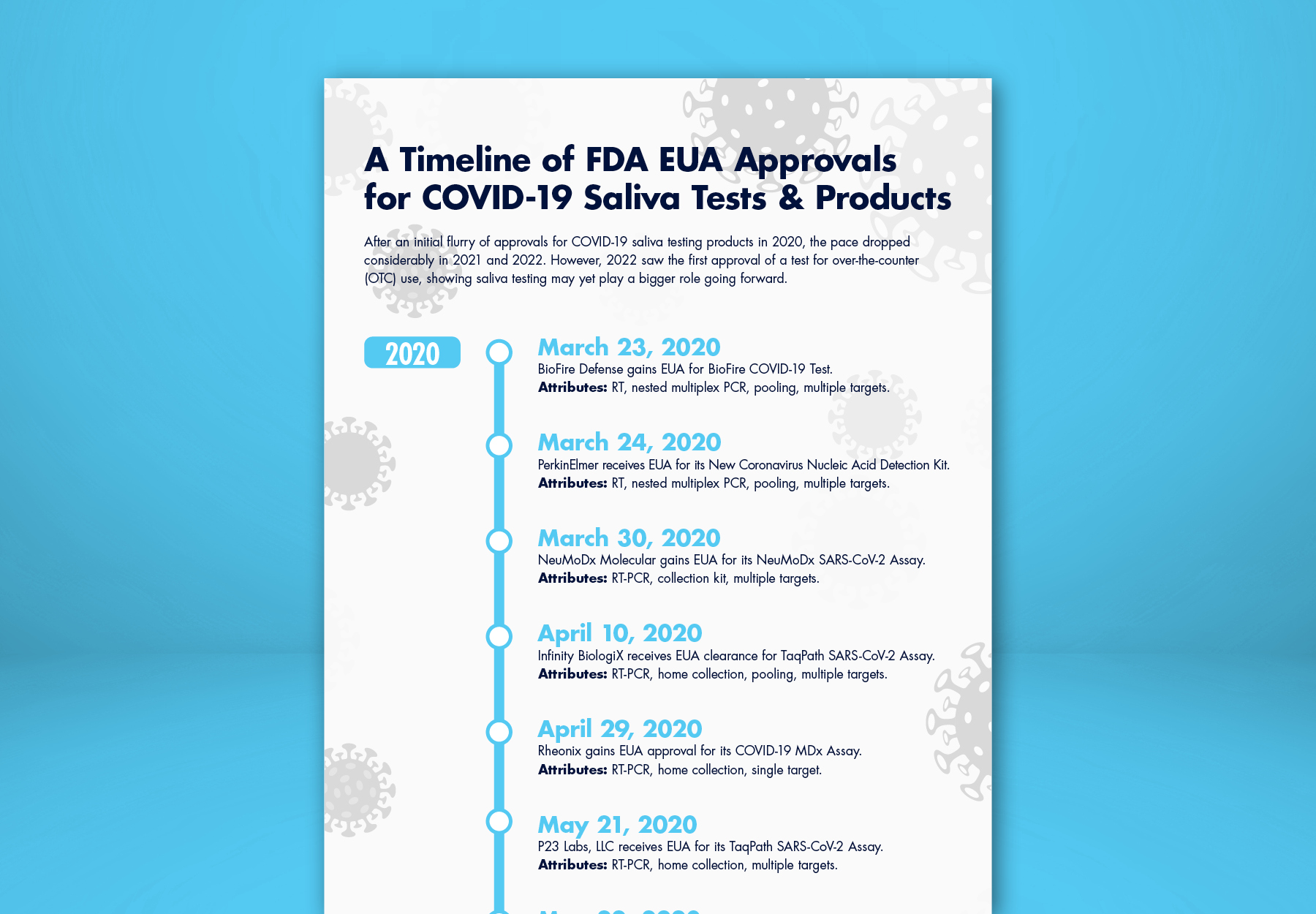

FDA Clearance of COVID-19 Saliva Products

Lab industry development of novel saliva-based diagnostics products in response to the PHE has been the primary driver of growth in the US and worldwide. In April 2020, less than three months into the PHE, Rutgers University secured the first EUA for a saliva COVID-19 test, the Rutgers Clinical Genomics Laboratory TaqPath SARS-CoV-2 Assay test which runs on the Thermo Fisher Applied Biosystems QuantStudio 5 Real-Time PCR System.4 A month later, Rutgers’ RUCDR Infinite Biologics received an expanded EUA for a saliva assay performed on samples that users collected at home and send to a laboratory for testing. The test, developed by RUCDR in partnership with Spectrum Solutions and Accurate Diagnostic Labs, became the first saliva assay to not require any physical interaction with a healthcare professional.5

As of publication date, 35 different saliva-based kits have received EUA during the PHE, many for use at the point of care. That includes products from not only academic institutions, but also leading commercial laboratory companies, including Thermo Fisher Scientific, PerkinElmer, BioMérieux subsidiary BioFire, Ambry Genetics, Rheonix, and NeuMoDx Molecular.

On Oct. 18, the FDA broke some new ground by issuing the first EUA for an over-the-counter saliva-based COVID molecular test to Aptitude Medical for the Metrix COVID-19 Test, a single-use test that uses real-time loop-mediated isothermal amplification (RT-LAMP) with a fluorescence reader to detect the SARS-CoV-2 virus.6

COVID-19 Saliva Testing Infographic

SARS-CoV-2 Saliva Diagnostic Products Cleared by FDA (as of November 23, 2022)

Source: FDA “In Vitro Diagnostics EUAs - Molecular Diagnostic Tests for SARS-CoV-2” Webpage, accessed November 23, 2022.7

Leading companies in the larger global saliva testing market include Thermo Fisher Scientific, Hologic, Qiagen, ACON Laboratories, Assure Tech (Hangzhou), Arcis Biotechnology, Abacus, Nantong Diagnos Biotechnology, KYODO INTERNATIONAL, Takara Bio, GeneProof, Vitagene, Therma Bright, Salimetrics, and Zymo Research.

References:

- https://www.frontiersin.org/articles/10.3389/fviro.2021.778790/full

- https://www.factmr.com/report/covid-19-saliva-based-detection-kits-market

- https://www.biospace.com/article/demand-for-covid-19-saliva-based-detection-kits-experienced-significant-growth-with-an-estimated-market-value-of-around-us-1-6-bn-states-fact-mr/

- https://support.rutgers.edu/news-stories/new-rutgers-saliva-test-for-coronavirus-gets-fda-approval/

- https://www.rutgers.edu/news/fda-approves-first-home-saliva-collection-test-coronavirus

- https://www.fda.gov/media/162401/download

- https://www.fda.gov/medical-devices/coronavirus-disease-2019-covid-19-emergency-use-authorizations-medical-devices/in-vitro-diagnostics-euas-molecular-diagnostic-tests-sars-cov-2

Subscribe to view Essential

Start a Free Trial for immediate access to this article