Enforcement Trends: OIG Calls Out CMS for Not Preventing Medicare Genetic Testing Overpayments

Inadequate CMS oversight resulted in $888.2 million in improper payments for the highest reimbursing molecular pathology genetic tests, report says.

More effective oversight by the Centers for Medicare & Medicaid Services (CMS) could have saved Medicare $888.2 million in improper payments for the highest reimbursing molecular pathology genetic tests. That’s the conclusion of a report published by the U.S. Department of Health and Human Services Office of Inspector General (OIG) on June 23, 2023.1 Here’s a briefing on the report and its potential compliance implications for labs that perform and bill Medicare for the tests the report cites:

Billing & Coding of MPPs

The OIG report focuses on the billing and coding of molecular pathology procedure (MPP) genetic tests. There are two tiers of Current Procedural Terminology (CPT) codes used to bill MPP tests:

- Tier 1 MPP CPT codes are used with testing for a specific gene, e.g., CPT code 81162 for testing genes linked to a higher risk of developing a certain type of breast cancer, and

- Tier 2 MPP CPT codes are used to report testing of a list of genes covered under the code.

Tier 2 MPPs may command higher reimbursement rates since they may be used for testing multiple genes. However, because the diseases that Tier 2 code tests target are generally rare, the expectation is that they’ll be performed in lower volumes than Tier 1 tests. Accordingly, the 2021 Medicare Clinical Laboratory Fee Schedule (CLFS) included 169 Tier 1 MPP codes and only nine Tier 2 codes.

CPT 81408 Tests

Medicare spending on high-priced genetic tests has been of growing concern to the OIG. The new report focuses on a particular Tier 2 code—CPT 81408—used to report a level 9 MPP for the testing of 24 different genes mostly associated with rare diseases. A lab may generally bill CPT code 81408 multiple times if it’s testing for multiple genes included under the code.

That the OIG would be suspicious of improper payment of 81408 MPPs is hardly surprising given their high price tag and the fact that most of the targeted genes are associated with rare diseases like Duchenne and Becker muscular dystrophy, Joubert syndrome, and Marfan syndrome. These syndromes also manifest in childhood and are thus not a common subject for testing the mostly elderly beneficiaries covered by Medicare.

In December 2021, the watchdog agency published a Data Brief noting that Medicare payments for genetic tests had increased 302 percent, from $351 million to $1.41 billion, between fiscal years 2016 and 2019.2

The key takeaway from a compliance perspective is the OIG’s emphasis on the top-heavy nature of the spike in genetic test spending. According to the report, payments for the five genetic tests with the highest total Medicare Part B payments during the audit period ($1.65 billion) made up 52 percent of the total payment ($3.15 billion) for genetic tests. Number two on that list is CPT 81408 tests, which went from $0 in FY 2016 and 2017 to nearly $284 million in FY 2019 and carried a 2021 CLFS reimbursement rate of $2,000, highest among all Tier 1 and Tier 2 MPPs and far higher than the second highest paying test amount of $1,160, for CPT codes 81229 and 81277, both of which are Tier 1 tests.

The OIG’s Five Findings

The new OIG report is a follow-up to the 2021 Data Brief. “Our objective was to determine whether [CMS’s] oversight of Medicare payments for CPT code 81408 was adequate to reduce the risk of improper payments,” the report notes.1 The OIG analyzed $888.2 million of Part B claims for over 450,000 genetic tests billed with 81408 for dates of service from 2018 through 2021. It concluded that OIG and the Medicare Administrative Contractors (MACs) didn’t do an adequate job of overseeing 81408-related payments. The report cites five failures on the part of CMS and MACs:

1. Failure to Ensure Enrollees Had Established Relationship with Ordering Providers

For CPT 81408 tests to be covered by Medicare Part B, there must be a relationship between the enrollee and ordering physician or nonphysician practitioner (NPP). The OIG concluded that of the 239,944 total enrollees associated with genetic tests billed under CPT code 81408 during the audit period, 193,085 (80 percent) didn’t have an established relationship with the ordering provider shown on the claim. Of those 193,085 enrollees, 166,779 hadn’t visited the ordering provider in the year before the date of service.

2. Failure to Ensure Payments Were Related to Diseases Associated with Genes Generally Billed and Tested Under that Code

Ordering providers also didn’t use code 81408 appropriately for the genes they were targeting. Specifically, the OIG found that essential (primary) hypertension— high blood pressure—was the principal diagnosis code on most of the claims billed under CPT code 81408 (24.3 percent). However, MAC officials told OIG that use of 81408 isn’t reasonable and necessary for hypertension.

3. Inadequate Monitoring of Number of Tests Billed Under 81408 vs Tier 1 Tests

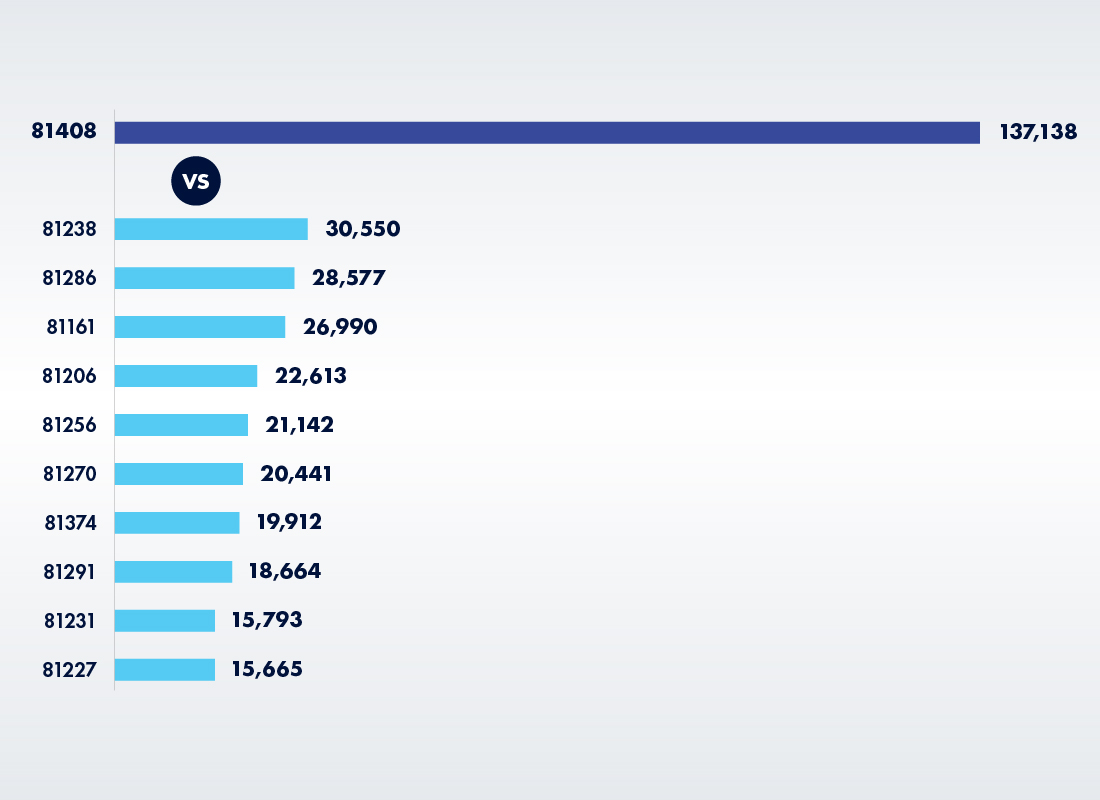

As noted earlier, Tier 2 tests should be used far less frequently than Tier 1 tests. So, somebody should have noticed that labs were billing what should have been a rarely used Tier 2 MPP at much higher rates than Tier 1 tests. Thus, in 2021, labs billed 137,138 genetic tests under CPT 81408, which was higher than the number of any Tier 1 tests and more than four times as many tests billed as for the top Tier 1 MPP code (81238).

Billing Volumes for 81408 vs 10 Tier 1 MPP Codes with Highest Billing Volumes (2021)

4. Failure to Identify Gene Tested by Labs that Billed CPT 81408

Because CPT 81408 covers multiple genes, MACs need to be able to identify the particular gene being tested to avoid improper payments. However, after interviewing MACs, OIG determined that some couldn’t identify the specific gene that labs using CPT 81408 were testing for, with capabilities varying significantly among different MACs.

5. Lack of Uniformity in CPT 81408 Coverage Rules

While five of seven MACs had Local Coverage Article (LCA) guidance banning or limiting use of CPT 81408, OIG found significant variances in coverage among MAC jurisdictions. “These differences in coverage may lead to confusion among laboratories and provide an opportunity for fraudulent billing, such as billing for tests that are not medically necessary,” the OIG report states.

OIG Recommendations

The failure of CMS and the MACs to adequately police payments of CPT 81408 tests might have cost the Medicare program up to $888.2 million over the four-year audit period, the OIG concludes. The report lists three recommendations:

Recommendation 1: Review Paid Claims

First, OIG called on CMS to review claims billed under CPT code 81408 during the audit period to determine whether they met Medicare requirements. CMS accepted the recommendation and said it will instruct the MACs to review a sample of claims to verify coding accuracy and, if the sample results warrant, carry out additional reviews.

Recommendation 2: Recover Any Improper Payments

Next, the OIG wants CMS to get the money back. Specifically, it recommended that the agency determine the amount of improper payments and recover the $888.2 million in claims that were at risk of improper payment if those claims are within the CMS four-year claim-reopening period. CMS neither accepted nor rejected that recommendation, but provided details to the OIG on how it plans to address it.

Recommendation 3: Notify Providers of Possible Improper Payments

Based upon the results of claims reviews, the OIG says that CMS should notify providers for which it finds credible information of potential overpayments to put those providers on the 60-day repayment rule clock. CMS has accepted that recommendation as well.

Takeaway & Practical Impact on Your Lab

The OIG report has a direct and immediate impact on any lab that billed Medicare Part B for MPPs using CPT code 81408 between 2018 and 2021. Your MAC is probably already performing a billing review on a sample of claims to ensure compliance with Medicare billing and coding rules. Best case scenario: The MAC will find no irregularities and that will be the end of it. More likely, at least based on the OIG report, the MAC will find grounds to believe that overpayments of CPT 81408 tests did occur. It may then perform a more extensive review, which will include claims from your own lab—assuming those claims weren’t already included in the random sample.

If you followed all the CPT 81408 billing and coverage rules, you should have nothing to worry about. However, if your MAC finds problems, it may notify you that you’re on the Medicare Reporting and Returning of Self-Identified Overpayments Rule 60-Day clock. Under that rule, labs and other providers that receive “credible information” about potential overpayments must exercise “reasonable diligence” to determine whether they’ve received any such overpayments and, if so, quantify the amount they received during a six-year period—although with CPT 81408 payments, the lookback period will be only four years.3,4

At that point, you’ll have to go back and audit all the CPT 81408 claims from 2018 to 2021 and determine if there were any overpayments. If so, you’ll have to report and return the overpayments found by the later of:

- 60 days after identifying the overpayments, or

- the date that any corresponding cost report is due (if applicable).

If you do identify overpayments, you may want to extrapolate your audit to consider the potential for overpayments for similar tests.

References:

- https://oig.hhs.gov/oas/reports/region9/92203010.pdf

- https://oig.hhs.gov/oas/reports/region9/92003027.pdf

- https://www.federalregister.gov/documents/2016/02/12/2016-02789/medicare-program-reporting-and-returning-of-overpayments

- https://www.cms.gov/newsroom/fact-sheets/medicare-reporting-and-returning-self-identified-overpayments

Subscribe to view Essential

Start a Free Trial for immediate access to this article