FCA Enforcement Activity Is Up but Recovery Dollars Are Down

The DOJ’s recent report on FCA enforcement statistics for FY 2022 shows that while actions are dramatically up, recoveries are way down.

It’s a bit of a head scratcher. False Claims Act (FCA) enforcement activity is dramatically up but FCA recoveries are dramatically down. That’s the principle takeaway from the U.S. Department of Justice’s (DOJ’s) report on FCA enforcement statistics for fiscal year (FY) 2022, which ended on September 30, 2022.1 Here’s a briefing of this year’s FCA recovery numbers and long-term trends as well as what they tell us about the current state of enforcement.

FY 2022 FCA Recoveries by the Numbers

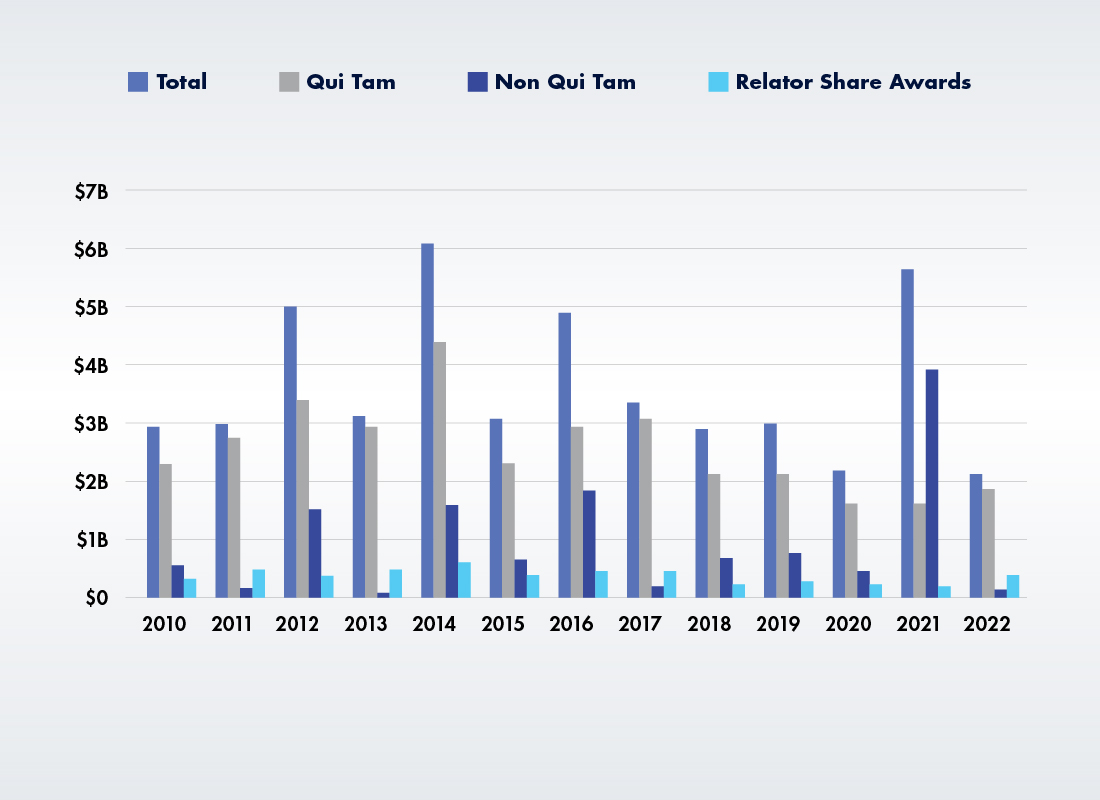

While it may sound like a lot of money, the $2,207,223,139 that the DOJ recovered in FCA settlements and judgments this year is less than 50 percent of the nearly $5.7 billion it recovered in FY 2021. It is also the lowest total over the last 15 years since the $1.42 billion of 2008.

DOJ FCA Recoveries, FY 2017 to FY 2022

| Fiscal Year | Non Qui Tam Recoveries | Qui Tam Recoveries | Total Recoveries |

| 2017 | $283,626,021 | $3,150,205,922 | $3,433,831,942 |

| 2018 | $769,596,453 | $2,214,972,569 | $2,984,569,022 |

| 2019 | $852,782,697 | $2,219,997,225 | $3,072,779,923 |

| 2020 | $547,903,198 | $1,716,345,380 | $2,264,248,578 |

| 2021 | $3,993,378,820 | $1,718,471,136 | $5,711,849,956 |

| 2022 | $245,586,952 | $1,961,636,187 | $2,207,223,139 |

False Claims Act Recoveries Since 2010

Source: Recreated from Whistleblower Law Collaborative.2

Enforcement Trends Analysis

Here are the key takeaways from the FY 2022 FCA recoveries numbers:

Healthcare Sector Is Footing the Bill: The one thing that never changes from year to year is the sector that’s paying out the most money. Thus, of the total $2.2 billion in FCA recoveries in 2022, more than $1.7 billion (almost 80 percent) came from healthcare cases, according to the press release accompanying the report.3

Volume of Enforcement Activity Is Increasing: The low recoveries total belies the fact that the government and whistleblowers were involved in 351 settlements and judgments, the second-highest number in any single year.3 The only explanation for this paradox is that damage awards and settlement amounts in individual cases are way down.

Most of the Money Is Coming from Qui Tam Suits: After last year’s statistical oddity in which total actions initiated by the government more than doubled qui tam recoveries, things returned to normal in FY 2022, with whistleblower suits accounting for over $1.9 billion (roughly 86 percent) of all FCA recoveries. The DOJ paid out $489 million in awards to the whistleblowers who brought these cases.

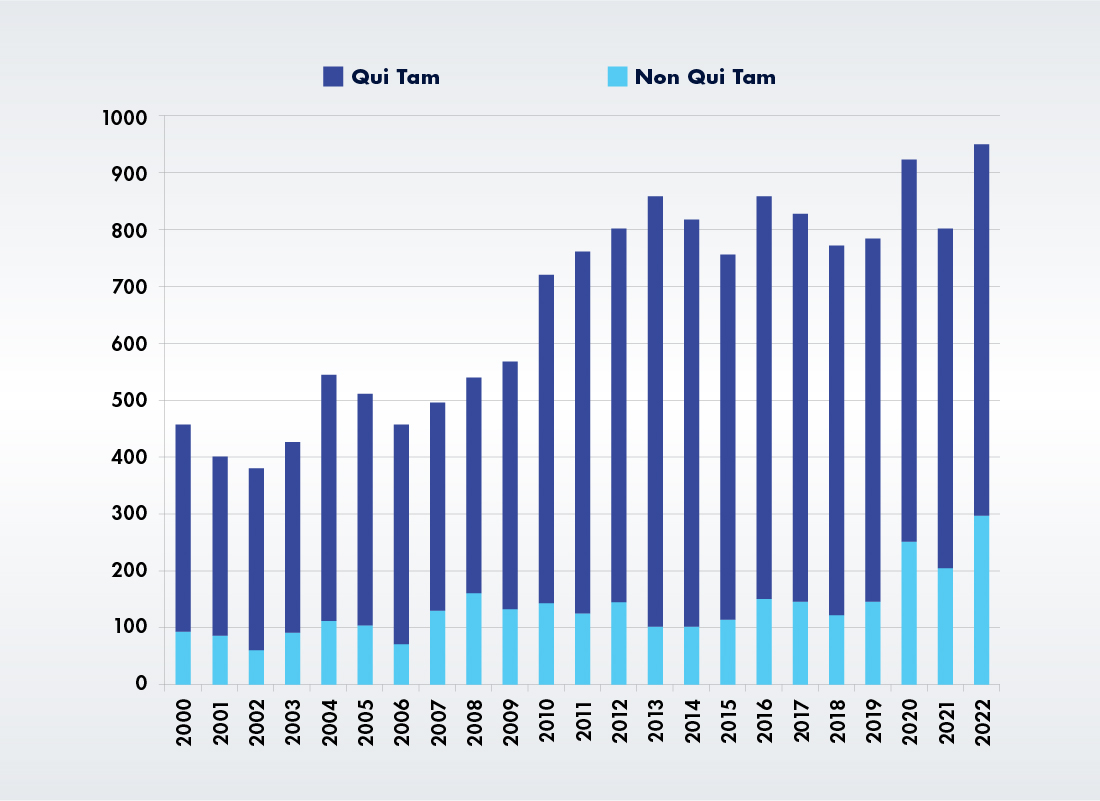

New Qui Tam Suits Are Continuing at a 600 Per Year Clip: There were also 652 new qui tam lawsuits filed last year. That’s the eleventh time in 12 years that new whistleblower suits topped 600. This year’s total represents a rebound from FY 2021 when new qui tam suits fell to 598 after reaching 676 the year before.

DOJ Is Staying Out of Qui Tam Cases: When whistleblowers file a qui tam suit, the DOJ must decide whether it wants to intervene in the case. More than $1.1 billion of the total 2022 FCA recoveries (approximately 50 percent) came from qui tam actions where the DOJ declined to intervene in FY 2022. That’s the first time in history that declined qui tam actions outpaced intervened qui tam actions in FCA recoveries. While noteworthy, this development is consistent with recent DOJ FCA qui tam intervention policies that were initiated by the Trump administration.4

DOJ Actions Are Also on the Rise: The DOJ initiated 296 FCA actions in 2022, the highest total since 1987 (340) and significantly above the 212 it initiated in 2021. The recent growth in non qui tam FCA actions began in FY 2020 when DOJ actions leapt from 150 to 261.

Types of FCA Enforcement Actions Since 2000

Source: DOJ, Fraud Statistics Overview.1 Chart recreated from: https://www.gibsondunn.com/2022-year-end-false-claims-act-update/.5

The Narrative

The insight that the annual FCA recoveries reports offer goes beyond the enforcement numbers. The reports also shed light on the kinds of fraudulent activity the DOJ and whistleblowers are targeting. As usual, clinical labs figured prominently in many of these priority areas.

Medically Unnecessary Urine Drug & Genetic Testing

As in previous years, illegally billing Medicare and other federal healthcare programs for medically unnecessary services was a major target for FCA enforcement in FY 2022, with some of the biggest cases targeting labs for unnecessary urine drug tests (UDTs) and genetic tests. The following are some examples of such cases:3

-

- Physician Partners of America LLC (PPOA) and its affiliated entities and principles paid $24.5 million to settle allegations of billing multiple UDTs at the same time without determining whether any testing was reasonable and necessary, or even reviewing the results of initial testing to determine whether additional testing was warranted. The DOJ also accused PPOA of instructing physicians to automatically order psychological and genetic testing that it didn’t use or intend to use, and to schedule biweekly telehealth appointments for the sole purpose of increasing revenue during the pandemic.

-

- MD Spine Solutions LLC dba MD Labs Inc. and two of its owners shelled out $16 million to settle allegations of billing for medically unnecessary UDTs.

-

- Inform Diagnostics paid $16 million to settle charges of billing for unnecessary additional testing on biopsy specimens before a pathologist’s review and without an individualized determination confirming the medical necessity for additional testing.6

- Radeas LLC paid $11.6 million to resolve allegations of billing Medicare for medically unnecessary UDTs by performing presumptive and confirmatory tests on the same urine sample at the same time.

Kickbacks

The DOJ raked in a lot of money from providers accused of violating the FCA by billing Medicare for services delivered as a result of illegal kickbacks paid to physicians in exchange for referrals. Notable examples include:

- Fifteen Texas-based doctors agreed to pay $2.83 million for allegedly accepting kickbacks for referrals to three companies providing lab testing services, one of which paid “volume-based commissions” to independent recruiters. These recruiters, in turn, used management service organizations (MSOs) to pay the doctors for the referrals, disguising the payments as investment returns [United States ex rel. STF, LLC v. True Health Diagnostics, LLC, No. 4:16-cv-547 (E.D. Tex.)].7

- BioReference Health LLC (formerly known as BioReference Laboratories, Inc.) and its parent company, OPKO Health, Inc., agreed to pay $9.85 million to settle charges of leasing office space from physicians at above-market rents to induce lab test referrals. BioReference allegedly overcalculated the amount of rental space for Patient Services Centers where patients could go for blood draws by including a “disproportionate share of common spaces” over which it didn’t have exclusive use, according to the DOJ.8

- Metric Lab Services, Metric Management Services LLC, and Spectrum Diagnostic Labs LLC had to cough up $5.7 million to settle charges of conspiring with marketing firms to pay kickbacks for genetic testing samples.9

Other Priority Areas

Other significant cases that the DOJ report cites involve Medicaid fraud and abuse, COVID-19 federal assistance fraud schemes, drug pricing, and Medicare Advantage ripoffs.

Takeaway

The 2022 FCA numbers suggest that the DOJ is recovering fewer dollars while exerting enforcement efforts that are commensurate with previous years’ totals. While qui tam lawsuits continue to account for most of the recoveries, the federal government is also choosing not to intervene in these cases at historically high rates, instead allowing whistleblowers to pursue these claims on their own. This corresponds with the increase in actions seeking dismissal of qui tam lawsuits that the DOJ perceives as lacking merit and/or not serving the public interest.

References:

-

- https://www.justice.gov/opa/press-release/file/1567691/download (Accessed April 11, 2023)

Subscribe to view Essential

Start a Free Trial for immediate access to this article