Special Report: Will the COVID-19 Recovery Be Bumpier than Expected?

Though IVD and commercial lab Q3 2023 earnings reports held promising signs, Q4 2024 and FY2023 results tell a different story.

The bumpy road to recovery from lost COVID-19 revenues seems to have gotten even bumpier for publicly traded diagnostic companies.

Readers of Laboratory Industry Advisor’s prior earnings special report in January may have walked away with the feeling that the decline in COVID-19 business among in vitro diagnostic (IVD) firms and commercial laboratory companies was finally in the rearview mirror.1 After all, we noted that in Q3 2023, there were signs of optimism for diagnostic companies.

But Q4 2023 and year-end earnings reports from the largest IVD manufacturers and commercial laboratory companies indicated that budgets had been hit even worse.

“The story that I’ve seen so far is huge declines in COVID testing revenues at a much larger rate than expected,” says Bruce Carlson, an IVD market expert. “For example, Roche goes from $4.7 billion to $900 million from 2022 to 2023 in full-year COVID testing revenue. That was unexpected. Roche expected declines, but they didn’t expect to go down to one-fourth.”

COVID-19 Testing Revenue Comparisons, FY23 vs FY22

| Company | FY23 | FY22 | Change |

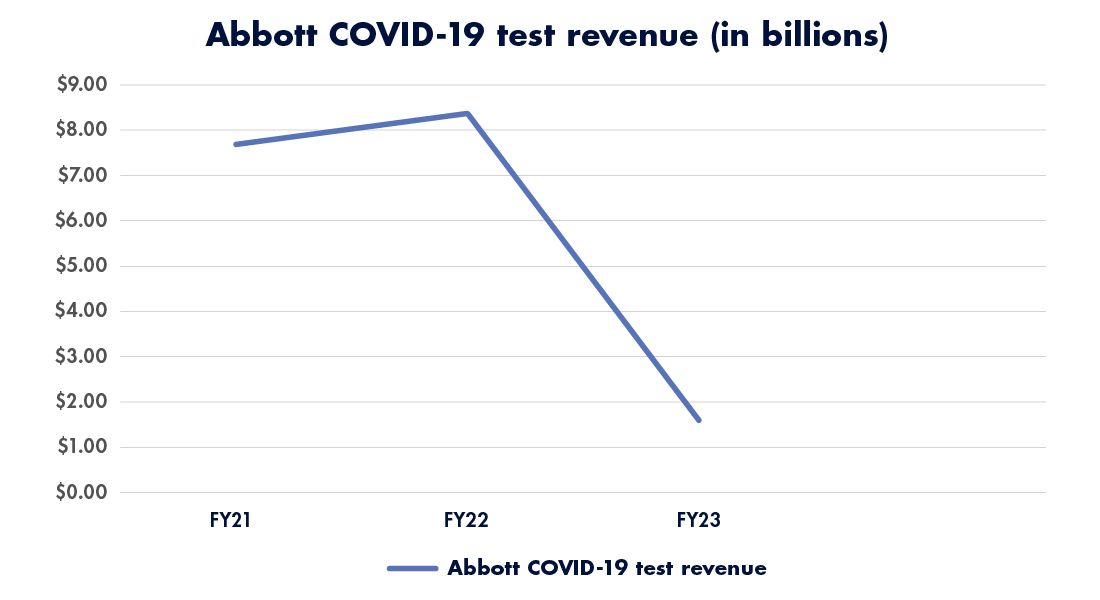

| Abbott Laboratories, Diagnostics Division | $1.59 billion | $8.37 billion | -81% |

| Roche, Diagnostics Division* | $910 million | $4.67 billion | -80.5% |

| Thermo Fisher Scientific, Lab Products Division | $330 million | $3.11 billion | -89.3% |

| Siemens Healthineers, Diagnostics Division* | $132 million | $1.63 billion | -91.9% |

| Becton Dickinson, Life Sciences Division | $73 million | $511 million | -85.7% |

Source: Company earnings reports

Abbott Laboratories’ Diagnostics Division saw a similar percentage drop with COVID-19 tests, with billions in lost revenue year over year (see Figure 1). COVID-19-related sales came in “much lower than originally forecasted,” said CEO Robert Ford during an earnings call on January 24.2

Carlson, who writes Carlson’s Eye on IVD blog on LinkedIn3, tells G2 Intelligence that the drop in COVID-19-related revenue isn’t because the tests are bad, but instead because of a widespread decrease in volume. Why? Fewer people self-test for SARS-CoV-2 these days, fewer hospitals test incoming patients, and the public continues to normalize COVID-19 infections as part of everyday life.

“Today, testing is not as common as it once was for asymptomatic people,” he says. “And for hospital admission in the US, they don’t do automatic COVID testing now.”

For its part, Roche anticipates that demand for at-home rapid testing for COVID-19 will not rebound; instead, labs will be the prime users of SARS-CoV-2 testing as part of respiratory panels, said Matt Sause, CEO of Roche Diagnostics, during an earnings call on February 1.4

“We expect the vast majority of [future] COVID-19 testing to be PCR based,” said Sause. “And I would add that we expect the majority of this testing to be performed in a multiplex format as part of a standard diagnosis of respiratory disease.”

Key takeaway: To recoup lost revenue, expect IVD companies to market other products more aggressively to clinical labs. Prices for products, services, and support may also logically increase.

IVD woes don’t equate to supplier instability

Laboratory customers should not consider the drop in revenue at IVD companies to be a long-term obstacle for any of them—and that is good news for labs that rely on these products.

“Labs cannot have their suppliers in trouble,” Carlson notes. “They want a healthy and flourishing IVD supplier market, and they want multiple options … Even if there are 25 companies making analyzers, you don’t want any of those companies going out of business because they are critical to a lab’s mission and supply chain.”

Medical labs already had a taste of supply chain pinch during the pandemic. IVD manufacturers that can provide needed equipment, supplies, and maintenance are crucial to day-to-day lab operations.

“During COVID, labs felt this pressure when suppliers were strained and labs couldn’t get technicians in for analyzer repairs,” Carlson recalls. “Today, a big consideration for labs is whether they get to see a technician when there’s a breakdown.”

A closer look at IVD-related revenue for FY23

Overall, the top IVD players had a muted year compared to 2022. Much, but not all, of the decline reflected lost COVID-19 revenues, as noted earlier.

Let’s look at some highlights and low points from six firms.

IVD Company Annual and Q4 Revenue Comparisons, FY23 vs FY22

| Company | FY23 | FY22 | Q4 2023 | Q4 2022 |

| Roche Diagnostics* | $16.06 billion (-20%) | $20.28 billion | $4.18 billion (-5.4%) | $4.42 billion |

| Abbott Laboratories, Diagnostics Division | $9.99 billion (-39.4%) | $16.47 billion | $2.53 billion (-22.7%) | $3.28 billion |

| Danaher, Diagnostics Division | $9.58 billion (-11.7%) | $10.85 billion | $2.72 billion (-8.4%) | $2.97 billion |

| Becton Dickinson, Life Sciences Division | $5.13 billion (-7.8%) | $5.56 billion | $1.33 billion (+3.3%) | $1.29 billion |

| Siemens Healthineers, Diagnostics Division* | $4.93 billion (-25.3%) | $6.6 billion | $1.32 billion (-16.2%) | $1.57 billion |

| Thermo Fisher Scientific, Specialty Diagnostics | $4.41 billion (-7.4%) | $4.76 billion | $1.11 billion (-0.9%) | $1.12 billion |

Source: Company earnings reports

Roche

Roche Diagnostics, a division of Roche, took in 14.1 billion Swiss francs ($16.06 billion US) in 2023, a decline of 20 percent year over year.5 Taking out currency fluctuations, the diagnostics division reported a decrease of 13 percent using constant exchange rates. Reduced revenue for COVID-19 testing largely led to the drop. However, non-COVID-19 base business for diagnostics increased by 7 percent, driven by sales of cardiac tests and diagnostics solutions for clinical chemistry.

Roche expects to release a series of new features and panels for its flagship cobas® analyzers, including respiratory testing and high-throughput clinical chemistry. The company will also debut its first continuous glucose monitoring product.

Abbott Laboratories

Abbott’s Diagnostics Division experienced a near 40 percent drop in sales in FY23 compared to a year earlier, again largely thanks to a gap in COVID-19 test revenue, according to company financials.6 However, the company took some of its earnings from the peak years of its COVID-19 business and invested in research and development, Ford noted during the earnings call.

Among the products that resulted is GLP systems Track,™ a lab automation system which the U.S. Food and Drug Administration approved in December 2023.

Danaher

Danaher’s Diagnostics Division—which includes Beckman Coulter, Cepheid, and Leica—saw an 11 percent drop in revenue for 2023.7 However, diagnostics base business had single-digit growth for the year, CEO and president Rainer Blair said during an earnings calls on January 30.

“Beckman Coulter Diagnostics led the way with over 10 percent core revenue growth, including double-digit growth in both instruments and consumables and notable strength in clinical chemistry and immunoassay,” Blair said.8

He also noted higher sales in 2023 of Cepheid’s four-in-one respiratory test for COVID-19, influenza A, influenza B, and RSV.

Key takeaway: In terms of IVD business, Danaher is now neck-and-neck with Abbott Diagnostics, largely due to Abbot’s FY23 decline. In FY22, Abbott’s diagnostic sales outpaced Danaher’s by almost $6 billion.

Becton Dickinson (BD)

Despite a near 86 percent drop in COVID-19-related revenue in FY23, BD’s Life Sciences Division ended its year on September 30 with a 3 percent increase in Q4 earnings compared to 2022.9

Overall, the division—which includes diagnostic products—saw sales decline by 7.8 percent in FY23.

Siemens Healthineers

Siemens’ Diagnostics Division saw a significant drop of 25 percent in annual sales compared to FY22.10 This was in large part to a $1.5 billion loss in COVID-19 testing sales. That rapid test line was discontinued in Q4 2023.

A source told Reuters in November that the company was looking into whether to sell its diagnostics business.11

Thermo Fisher Scientific

Thermo Fisher’s Specialty Diagnostics Division saw a 7 percent decline year over year in sales, and, similar to other IVD companies, also saw steep COVID-19 revenue losses.12

However, the company reported growth in its core diagnostic business, including transplant diagnostics, microbiology, and immunodiagnostics.13

Revenue Struggle Costs CEO a Job

IVD manufacturer QuidelOrtho fired CEO Douglas Bryant on February 21, shortly after releasing FY23 figures that showed a decrease in annual sales to $3 billion.14 That represented a 9 percent drop from the prior year.

Bryant had been CEO for 15 years and oversaw the merger of Quidel and Ortho Clinical Diagnostics in 2022.15

“Overall, his firing was a result of the financial release, which had been lower than expected—8 percent down overall—mostly due to reduced COVID revenue,” says IVD market expert Bruce Carlson.

Chief commercial officer Michael Iskra was named interim CEO at QuidelOrtho.

It remains to be seen what changes, if any, the other IVD firms will make on the executive level. Some companies had far steeper diagnostic losses than QuidelOrtho did.

Laboratory companies offer a mixed bag with financial results

The two biggest commercial laboratory companies saw different endnotes to their fiscal years.

Overall, Labcorp enjoyed a 2.5 percent increase in annual revenue in FY23. The company’s base business, which does not include COVID-19 testing revenue, was up 8.7 percent in FY23, but offset by an 8.1 percent decrease in COVID-19-related revenue, the company reported.16

For Q4 alone, COVID-19 testing revenue was down 73 percent year over year, CFO Glenn Eisenberg said during an earnings call on February 15.17

At Quest, the overall news wasn’t as good. The company reported a loss of 6.4 percent in annual sales from 2022 to 2023.18

Full-year base revenue was up 7.1 percent to $9.03 billion. However, COVID-19 testing revenue fell during the year by 84.7 percent, the company noted.

Commercial Lab Annual and Q4 Revenue Comparisons, FY23 vs FY22

| Company | FY23 Full Year | FY22 Full Year | Q4 2023 | Q4 2022 |

| Labcorp | $12.2 billion (+2.5%) | $11.9 billion | $3 billion (+3.5%) | $2.9 billion |

| Quest Diagnostics | $9.25 billion (-6.4%) | $9.88 billon | $2.28 billion (-1.9%) | $2.33 billion |

Focus areas in 2024 for Labcorp and Quest include tests for the following:

-

- Alzheimer’s disease and other neurological illnesses

-

- Oncology

-

- Women’s health conditions

- Autoimmune disease

Key takeaway: Community labs that are interested in promoting new services may want to look at their own ability to market tests for the above conditions. For example, if a local lab can get ahead of competitors by touting its ability to test for early-stage Alzheimer’s, it could result in new customers.

Also, Quest and Labcorp continued to acquire laboratory outreach programs or contract to perform professional lab services for health systems during 2023, each signing several agreements.

One deal of note was that Quest acquired certain lab outreach sectors of Steward Health Care System’s operations in Massachusetts, Ohio, and Pennsylvania. Steward has indicated it may leave the Massachusetts market amid steep financial losses, according to WBUR radio.19

The Steward Health deal is indicative of a typical scenario for outreach acquisition, in which a troubled health system is looking for a cash infusion.

Meanwhile, both companies reported briefly on test volumes and price per test numbers for Q4 2023. Labcorp saw its volume increase 2.4 percent while staying flat on price, while Quest had a 1.9 percent increase in requisitions, yet a negative 3.5 percent reduction in price per test.

Lab Test Stats Q4 Year-Over-Year

| Laboratory company | Q4 test volume | Q4 price per test |

| Labcorp | +2.4% | +0.2% |

| Quest Diagnostics | +1.9% | -3.5% |

Conclusion: Three areas for clinical labs to consider

IVD manufacturers and commercial laboratory companies continue to face the daunting task of making revenue goals in an environment that does not include pandemic-related testing opportunities.

All of these firms knew the boost in revenue from COVID-19 testing would subside to some degree. However, it’s clear based on comments from some executives that the revenue dropoff was sharper, and perhaps quicker, than expected.

As we progress into the second half of 2024, medical laboratories should keep an eye out for the following three developments:

-

- Will IVD companies and commercial labs be able to take lessons they learned during the pandemic—such as how to scale operations quickly or use automation more effectively—and translate it into non-pandemic efficiencies?

-

- How will the hunt to reclaim gaps in IVD revenue affect other business lines that clinical labs may be customers of?

- Can IVD companies—and by inference, diagnostic labs—secure some sort of recurring COVID-19 revenue by combining those tests into larger respiratory panels?

Hopefully at some point, earnings calls and financial releases will not have to devote time to explaining base revenue against COVID-19 testing losses. Whether that happens in 2024 remains a hazy prediction for now, given how significant 2023 revenue declines were at some companies.

References:

3. https://www.linkedin.com/newsletters/carlson-s-eye-on-ivd-6930168853557600256/

4. https://seekingalpha.com/article/4666993-roche-holding-ag-rhhby-q4-2023-earnings-call-transcript

5. https://assets.roche.com/f/176343/x/5a5b5d48d1/240201_ir_fy23_en.pdf

7. https://investors.danaher.com/2024-01-30-Danaher-Reports-Fourth-Quarter-and-Full-Year-2023-Results

8. https://seekingalpha.com/article/4666050-danaher-corporation-dhr-q4-2023-earnings-call-transcript

10. https://www.siemens-healthineers.com/press/releases/2023q4

15. https://www.g2intelligence.com/ma-report-the-top-15-diagnostic-deals-of-2022/

17. https://finance.yahoo.com/news/laboratory-corporation-america-holdings-nyse-144133332.html

19. https://www.wbur.org/news/2024/01/19/steward-health-care-says-financial-difficulties-jeopardize-care-at-mass-facilities

Subscribe to view Premium

Start a Free Trial for immediate access to this article